Health Choice Advisor & Associates

Financial & Insurance Services

Bridging The Gap To Your Retirement

We help individuals, families, and businesses in Michigan with personalized financial retirement and health insurance solutions.

Independent Advisory Firm

Access to Multiple Options

Dedicated to Serving You

Health Insurance Services

Individual Life and Health Insurance

We take your well-being seriously with our health and life insurance services. Whether you need individual health insurance to meet the requirements of the ACA or short-term medical coverage to fill the gap between jobs, we can help you find a plan. We offer policies for your family that include health, dental, vision, prescription coverage and more.

We also understand the importance of protecting your family’s finances and managing the risks posed by potential adverse life events. We offer insurance plans to protect you and your loved ones from accidents and hospitalization. Our innovative life insurance options include term and permanent life, disability coverage, and long-term care solutions, ensuring all aspects of your family’s life are covered.

- Health Insurance / Short-Term Medical

- Dental and Vision

- Prescription Coverage

- ACA Coverage

- Life Insurance – Term and Permanent

- Long-Term Disability Insurance

- Hybrid Long-Term Care Coverage

Health Care & Medicare

Medicare Advantage, Supplemental & RX Coverage

Many people turning 65 and still working make the mistake of not educating themselves on the benefits of a Medicare plan versus their existing group plan, especially if they plan to work after age 65. With some Medicare plans, there are virtually no deductibles or costs for medical procedures, which are billed very differently than a group medical plan. Do yourself a favor and make an appointment with our team to learn how a Medicare plan could save you thousands over a group plan.

Most folks nearing retirement age also make the mistake of thinking that signing up for Medicare at 65 means they won’t have to pay for health care expenses in retirement, only to find out that Medicare premiums are higher than they expected—and that they get taken out of their Social Security checks.

You don’t have to navigate the complex world of Medicare alone. We offer Medicare services right here in our offices, virtually or over the phone to help you find the right Medicare policy to fit your specific needs, wants, and budget. We also offer options for long-term care insurance to help protect you.

Medicare Advantage Plans

Medicare Rx, Dental & Vision

Medicare Supplemental “MediGap” Policies

Hybrid Long-Term Care Policies

Financial Retirement Planning

Retirement Security Solutions

Retirement is a completely different stage of life. You’ve been putting money away your whole career in anticipation of the day your paycheck stops. When will you have enough money to retire? How do you know which accounts to tap first? How will you keep from running out of money during retirement?

We specialize in financial retirement planning because we’ve had many clients with these same concerns. Innovations in tax-advantaged insurance have helped address multiple risks facing retirees. There are now ways to create lifetime income, transfer wealth to heirs, secure coverage for long-term care, and more. Contact us today for more information and to setup a no obligation, no cost financial retirement review.

(please make ‘contact us’ in above paragraph hyperlink to contact us page)

- Retirement Planning

- Income Planning

- Asset Protection

- Portfolio Reviews

- Annuities

- Long-Term Care

- Tax-Advantaged Life and Estate Planning

- Tax-Advantaged Wealth Transfer

Get Your Risk Number

Riskalyze, the world’s first risk alignment platform, mathematically pinpoints your Risk Number® to help pinpoint your comfort level with risk. Built on a Nobel Prize-winning framework, Riskalyze quantifies your Risk Number, a number between 1 and 99 that pinpoints your comfort zone for downside risk and potential upside gain.

Riskalyze was twice named one of Fast Company Magazine’s 10 most innovative companies in finance and has appeared twice on the Forbes FinTech50 list.

Group Plans

Health & Retirement Solutions

We assist small businesses and organizations in our community with group health and retirement benefits. We understand what you need to attract and retain the best employees and members, and in some cases, we recommend partnering with a Professional Employment Organization (PEO).

From life and health to retirement, we offer a range of options from multiple carriers to help ensure you’re getting the best coverage for your employees (and yourself). Our goal is to mitigate your risk from unexpected or adverse events, retain key talent, and ensure a smooth succession plan.

- Group Health/ Dental/ Vision/ Supplemental Insurance

- Retirement Plans

- Life Insurance/Key Man Insurance

- Short and Long-Term Disability

- Long-Term Care Insurance

- Risk Management

- Hybrid Long-Term Coverage

Read Our Latest Blog Post Articles

Set up a meeting

with us now.

Contact Us

SET UP A MEETING WITH US NOW

Health Choice Advisor, Inc. is an independent financial and insurance services firm that utilizes a variety of investment and insurance products. Investment advisory services are offered only by duly registered individuals through AE Wealth Management, LLC (AEWM). AEWM and Nolan McIntosh are not affiliated companies.

Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss during declining values. None of the information contained on this website shall constitute an offer to sell or solicit any offer to buy a security or any insurance product.

Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult a qualified professional for guidance before making purchasing decisions.

Links to third-party websites are being provided for informational purposes only. AEWM is not affiliated with and does not endorse, authorize, or sponsor any listed websites or their respective sponsors. AEWM is not responsible for the content of any third-party website or the collection or use of information regarding any website’s users and members. The information and opinions contained in any of the material requested from this website are provided by third parties and have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. They are given for informational purposes only and are not a solicitation to buy or sell any of the products mentioned. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Stephan Bushon

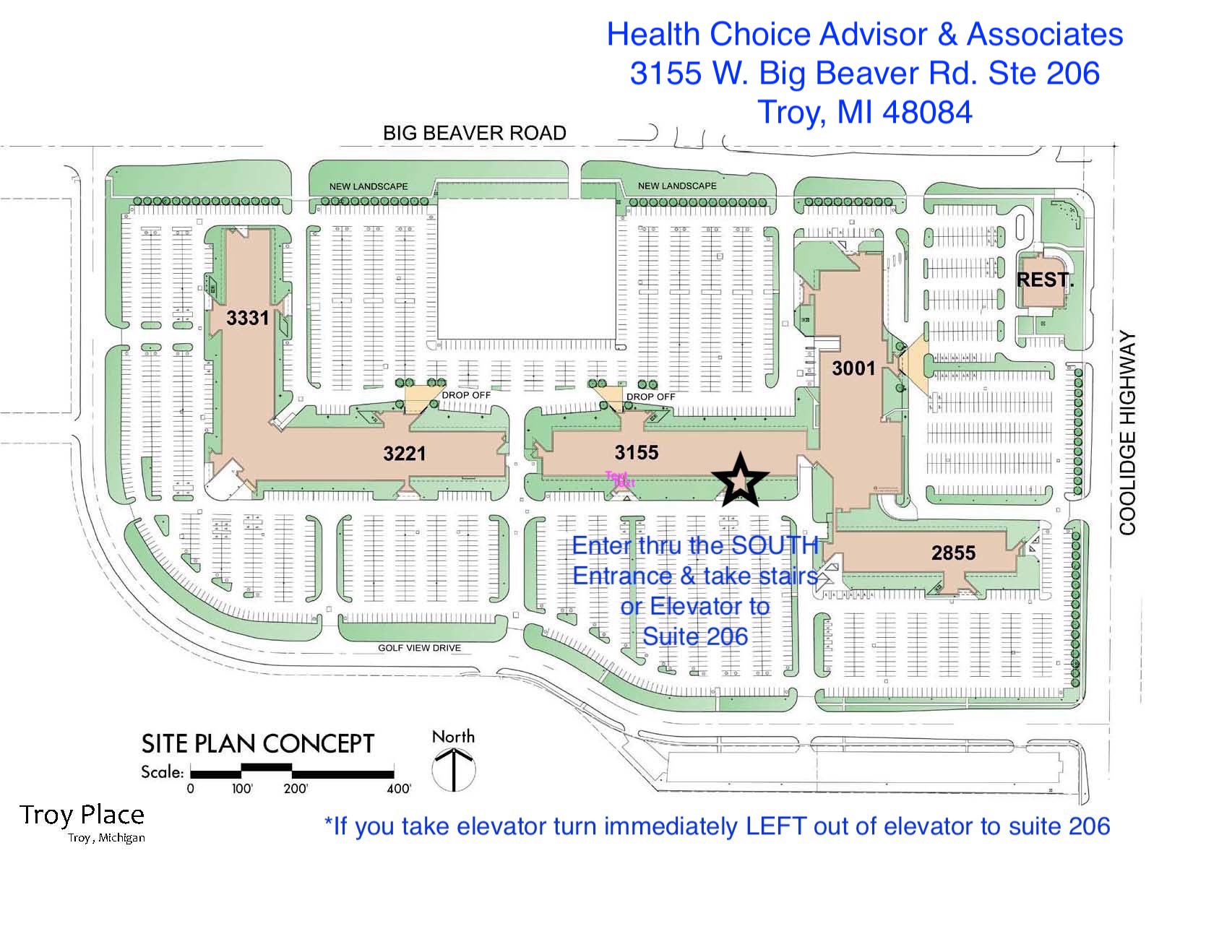

Health Choice Advisor & Associates

3155 West Big Beaver Rd, Suite 206 Troy, MI 48084

248-640-0656

Fax: 248-268-0088

bushons@gmail.com